Written by Silja Fröhlich

Published on 15th February 2021

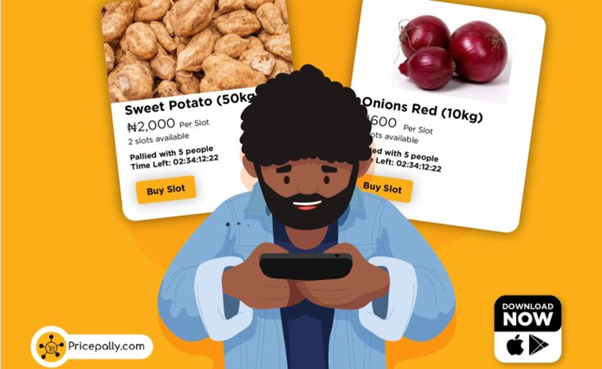

Nigerian entrepreneur Luther Lawoyin’s cooperative platform, PricePally, enables multiple households to order groceries jointly and benefit from lower prices.

As COVID hits Africa’s economy hard, young entrepreneurs have declared war on the disease. Many startups have found creative ways to resolve added challenges caused by the pandemic.

The Nigerian entrepreneur Luther Lawoyin’s fourth startup is a food cooperative platform, PricePally, through which several households can place a joint order of groceries, and benefit from lower prices.

In 2019, just before the start of the coronavirus pandemic, Lawoyin’s wife suggested that an e-commerce platform would enable bulk food deliveries in the Nigerian city of Lagos.

“My wife writes down everything we spend. I looked at the data and was surprised by how much we pay for food,” the young entrepreneur told DW.

“We came up with the idea of buying in bulk for us and thought it could be a solution for a lot of people,” Lawoyin said.

Lawoyin’s is one of many African startups that have thrived throughout the pandemic. Africa has suffered disproportionately from the global economic depression caused by the disruption.

Economic activity in sub-Saharan countries shrunk by 3.3% in 2020, according to preliminary calculations by the World Bank.

Despite the pandemic, many African startups are thriving. International investors have noticed.

The total venture capital for African startups grew to $1.31 billion (€1.08 billion) in 2020, up from $1.27 billion in 2019, according to the think tank Briter Bridges.

And the winner is … fintech

“2020 took everybody by surprise,” Nicholas Kendall of GreenTec Capital Partners, an investor that specializes in African startups, told DW.

“It was a slow year, and the winners were determined by who was able to adapt,” Kendall said. “Despite what is happening, the number of deals in Africa has continued to grow. African startups continue to be very attractive to international venture capital, and Africa is always growing.”

Leading the way are startups with innovative financial solutions. “Fintech is still king in Africa,” Kendall said.

“But all the sectors that have managed to go digital have been successful. It’s all about adaptability.”

Fintechs in Africa alone accounted for 31% of total investment in 2020, according to Briter Bridges.

Two out of three African adults don’t have bank accounts, creating a huge market for digital financial services.

COVID drives innovation

Clean energy has the second biggest share of investments. Governments and private investors in East and West Africa are focusing on solar startups to bring electricity to remote locations.

Because of the pandemic, interest in the health sector is also growing. The World Health Organization (WHO) found that the COVID pandemic in Africa had spurred the development of more than 120 innovations in health technology. They represent one-eighth of the roughly 1,000 anti-pandemic technologies worldwide analyzed by the WHO.

Analogous to fintech, there is also a term for applications that deal with education: “Edtech is, of course, very important,” Kendall said.

In Africa, schools had to shut down for months because of the pandemic and many students turned to the internet for learning.

“It’s not as big and it’s not as splashy, but telehealth and online education are definitely sectors to watch,” Kendall said.

Africa’s ‘big four’

Kenya, Nigeria, South Africa and Egypt are Africa’s “big four” from a funding perspective.

Together they account for 77% of companies started with borrowed capital and 89.2% of startups totally funded by venture capital, according to the African Tech Startups Funding Report 2020. The year saw $190 million in investments flow into Kenya, which remains at the top of Africa’s list of recipients.

But there were also losers owing to the coronavirus. “Of course, many startups were hurt in their operations,” said Kendall. “And I’m sure plenty of people did not launch their startups or launches were delayed.”

‘Innovate or die’

“It was particularly bad for startups that were directly affected by COVID-19, like tourism,” Lawoyin said.

Some of them didn’t survive, he added. For his own startup, 2020 was challenging, “but it also helped the business grow and take shape.” Lawoyin knows a thing or two about failed startups: he’s already had to abandon two of his own.

The reason entrepreneurship hasn’t dwindled in Africa is because fundamental problems were already in place before the pandemic, Lawoyin said.

“We have basic problems to solve like energy, housing, food,” Lawoyin added. “They force us to innovate. We must find solutions no matter how risky it is. You either innovate or die.”

What it really comes down to, Lawoyin said, is collaboration. “You cannot get this done on your own. Collaborate in going digital and looking for ways to overcome hurdles.”